you can't beat m..

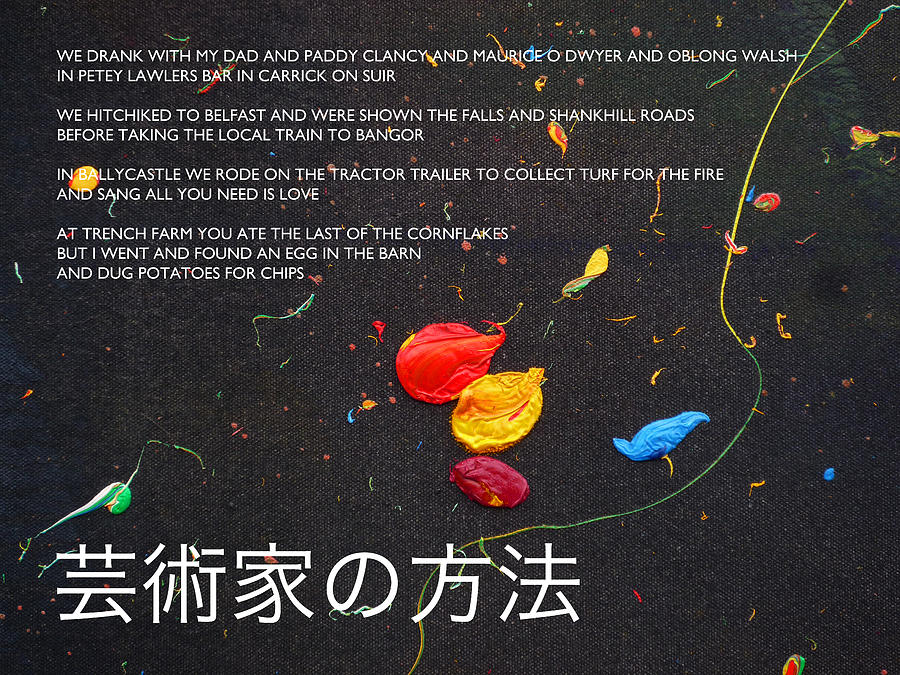

red, yellow and blue..

how can you not be inspired..

native american art does it for me

Boeing

is more than the tip of the iceberg.

Plane orders by the virtue of the

dollars involved immediately show up in export and gdp numbers.

i know nobody is talking much about it..

but i still expect the 737-max to be cancelled.

"I first became aware of Christopher back in 1976.

I was a graduate trainee at a merchant bank and he was a reporter with the

Daily Mail.

We first met properly when he came into my bank to give a lecture.

Even back then, in the Seventies,

he was considered one of the

most intelligent, trustworthy and convivial of City journalists.

In

those days, unusually for a journalist,

he wore a bowler hat and a button-hole carnation...."

"In the days when Mr Woodford was

launching his fund,

Mr Carney was newly arrived at the Bank.

key

rate of interest—Bank rate—was at its lowest for three centuries.

He has

left it like that ever since.

By now, the rate of return on some British government stocks is..

barely half today’s rate of inflation: loss

of value guaranteed to investors.

In Germany, this sort of investment

would be even dearer,

for Europe’s central bank is not far out of step

with our own,

and so is the Federal Reserve in Washington.

It is only natural that investors in search of returns should look further and further afield.

So, as Mr Carney notes, they have poured money into the world’s “emerging markets”

—although every so often these

markets submerge and their backers cannot emerge from them.

They put

hopeful prices on the supposed wonders of new technology,

without

waiting for them to generate earnings.

This is their response to the central bankers who,

a decade ago,

made money cheap in response to a

crisis and have kept it that way ever since.

A distorted market produces

unwanted results.

Mr Woodford’s followers have found this out the hard way."

THE MAN WHO SOLD OUR GOLD

"All the same, these arrangements worked well for two centuries,

and it

was left for Gordon Brown in his reforming mode to do away with them.

He

saw no need for a Government Broker,

and he took the agency back from the Bank."

-------

We don’t like the risk/reward of the market currently, and suspect we will have a better opportunity to increase equity risk later this summer. But, if things change, we will also.

What is essential is remembering one investing truth. Investing isn’t a competition of who gets to say “I bought the bottom.” Investing is about putting capital to work when reward outweighs the risk.

That is not today.

Bear markets have a way of “suckering” investors back into the market to inflict the most pain possible.

Such is why “bear markets” never end with optimism but in despair.

NONE OF THE ABOVE IS ADVICE

what's said in palookaville..

stays in palookaville..