Friday, 28 November 2008

SCARLET RIBBONS

PALOOKAVILLE FINANCIAL stardate : capitulation day+70

...Christmas is coming and here in PALOOKAVILLE we are less that festive...

...as we watch...the world continues to f*ck up the future...

...young men who should be out having fun, building careers, handing in...

...project work or essays... making love to beautiful women....

...are walking around hotels shooting dead regular joes an janes for doing nothing...

...more than living their lives in peace...

...these young men are the agents of older sadder people who...

...wish to start a war in their own little part of the world...

...the chaos of war will...they hope...bring them the power they crave...

...the power to order others about...to make others obey their will...

...they are mortals who pretend to themselves and anyone who will listen...

...that a God would have them do this in God's name...

halfcat : so...boss..wot yo want fo xmas man?

petey : peace on earth brother...

zooneh : an end ta the bust would be nice...

spider : 8 legs...

opkin : suckers stop sayin ahm a rat...

beulah : food an clean water fo africa...

laverne : rock hudson...

STC : Aloof with hermit-eye I scan

The present works of present man--

A wild and dream-like trade of blood and guile,

Too foolish for a tear, too wicked for a smile!

Sunday, 23 November 2008

THE SINGIN INVESTOR

PALOOKAVILLE FINANCIAL stardate : capitulation day+65

...they say that itz impossible to sing under water...

...but then they said that a trouble inna financial markitz would not

impact the real economy...

ACCENTUATE THE POSITIVE

painty : here in PALOOKAVILLE folks don pay no notice ta no doom an gloom sh*t...

...they all aware at some local difficulty woz kikkin bankers asses fo a while but

...nah it all ovva... an a nice politix ave fixed it right up...

...aint noboddy rahn heah got no dough any how...

...prices o gas n stuff fallin so beulah an laverne can keep on shoppin...

...shock an scares gettin cheaper by a day...so ah might jus get me one a them...

...fancy pension plans..

...allas buy inna sale innit?...guess i'll jus tek me own sweet time though...

zooneh : yo house price connected to yo mortgage price...

...mortgage price connected ta yo bank price...

...bank price connected ta yo share price...

...share price connected ta yo job price...

...job price connected ta yo bailout price...

...bailout price connected ta yo tax price...

spider : STFU zooneh!..yo divot...

market ticker :..."The better question is whether the rally Friday afternoon was something real or just more BS. We'll know early this coming week. If we can break back above 800, the intermediate-term rally case has more credibility. Over 850ish, it has significant credibility. Of course if we immediately collapse and head lower..... brimstone.

petey : wot? still ere? aintcha got no ome ta go ta?...gerra wife!.....hahahahaha.....

Thursday, 20 November 2008

HERE COMES THE TWIST

PALOOKAVILLE FINANCIAL stardate : capitulation day+62

...evva body know...a five yeah plan...

Now you're looking good

I'm gonna sing my song and you won't take long

We gotta do the twist and it goes like this...

Come on let's twist again like we did last summer

Yea, let's twist again like we did last year

Do you remember when things were really hummer

Yea, let's twist again, twistin' time is here...

Yeah round 'n around 'n up 'n down we go again

Oh baby make me know you love me so then

Come on let's twist again like we did last summer

Yea, let's twist again, twistin' time is here...

U.S. Stocks Gyrate as Auto-Industry Rescue Offsets Jobless Rise

Wednesday, 19 November 2008

CRY ON THE DIPS

PALOOKAVILLE FINANCIAL stardate : capitulation day+61

...an investor...undressed as Burt Lancaster...is attempting to bring back the bull market by swimming...under water...through every pool in FUNDSVILLE...

...the story takes place in the affluent suburbs of Westchester County, New York, and focuses on Bully Bulltard, who despite being middle-aged, wants to grow his pension fund and believes that he is a shrewd investor...

...he marvels at his trail-blazing idea of "swimming the county"...

...at the beginning of the story, Bully is at a cocktail party at a local investment club and realizes that by following an imaginary chain of private and public pools in his affluent community he can literally swim to retirement...

...next we have a succession of similar scenes, as Bully enters the backyard of his neighbours...

...sometimes bursting into a party, sometimes engaging in conversation, and most of the time having a drink - but always swimming the length of their pool. Soon it becomes clear to the viewer that something has gone awry.

...at first Bully is well-received in the backyards and pools, but after finding a dried pool and waiting for a storm to pass in a gazebo, he starts to feel tired and disillusioned with his idea...

...although he is still determined to go on, he can hardly remember the excitement he first had at the investment club...

...Bully is terribly upset to find out that the Welchers' pool was dry, in fact their house was up for sale...

...he recognizes that his memory must be failing him or he is repressing unpleasant facts for not remembering what had happened to the other bulls...

...at the Halloran residence, Mrs. Halloran tells Bully she is sorry to hear of his misfortunes which, again his memory seeming to fail him, cannot remember, although Mrs. Halloran mentions Bully selling his house and something about his children...

at the Biswangers’ he is received as a gate-crasher and even their barman treats him with disrespect...

...he overhears Mrs. Biswanger saying that someone, possibly Bully himself, showed up one day asking for money since he went bankrupt...

...further on, bully's former mistress Shirley Adams, whom he cannot even clearly remember having an affair with, tells him that she won't "give him another cent".

...several signs indicate that time is passing more rapidly than Bully realizes...

...he slowly observes that each pool is significantly colder and much more difficult to swim...

...by the end of the story, Bully is unable to recognize the constellations of the midsummer sky, instead finding the northern constellations Andromeda, Cepheus, and Cassiopeia, implying a change of season....

...in the story's conclusion, Bully reaches his retirement...

...as he looks inside the locked and deserted home, he wonders why his money is not there anymore...

in fact...it's all gone!

REVIEW...John Cheever's "misery in suburbia" short stories, brief and to the point, have always proven excellent TV fodder. Director Frank Perry's The Swimmer, adapted for the screen by Perry's wife Eleanor, is a rare, and for the most part successful, attempt at offering a Cheever story in feature-length form. Dressed only in swimming trunks throughout the film, Burt Lancaster plays a wealthy, middle-aged advertising man, embarked on a long and revelatory journey through suburban Connecticut. Lancaster slowly makes his way to his split-level home by travelling from house to house, and from swimming pool to swimming pool...."

petey : don go near the water...don do the swim...

Monday, 17 November 2008

THE BOOT GOES IN

PALOOKAVILLE FINANCIAL stardate : capitulation day+59

...ok...this'n be a update on that un

...beatin up on george...part two...

MACHIAVELLI

...Superb at ice-hockey, a prince at the dance...

...He's fierce as tigers, secretive as plants.

...my dad allas called im that...mandelson...that is...can't think why...

...anyway here he be...a joinin in a bellyachin about po ol george...fo tellin a truth...

mandy : "What George Osborne was trying to do in his remarks was undermine the confidence of markets and undermine the confidence of traders that the medium-term direction of government policy is sound.

"That's why what he was doing, frankly, was reckless and irresponsible."

He insisted that the Government's stimulus package, which is to be unveiled in next week's Pre-Budget Report, was necessary to revitalise the economy and restore confidence among consumers and lenders.

He added that this was "internationally recognised", in the wake of the weekend's G20 meeting in Washington.

He also accused Mr Osborne and David Cameron, the Conservative leader, of contradicting themselves on the economy. "Their policies change from week to week," Lord Mandelson said.

ossie : On Sunday, Mr Osborne launched a robust defence of his response to the global economic crisis, insisting that he was "absolutely sure" that he was "doing the right thing".

The shadow chancellor said that he had a duty to tell the public "the truth" about Britain's economic problems and denied accusations that he had risked worsening the problem by warning of a run on sterling.

He refused to back a programme of tax cuts being drawn up by Gordon Brown which is expected to be unveiled in next week's Pre-Budget Report.

Mr Osborne has faced criticism from sections of the Conservative Party over his handling of the economic crisis amid claims he failed to foresee the seriousness of the problem. Some right-wing peers and MPs have called for him to be replaced.

The party's opinion poll ratings have fallen sharply and David Cameron has refused to call for big tax cuts - instead focusing on the need to keep Government borrowing under control.

Speaking on BBC's Andrew Marr show, Mr Osborne said that the approach had been correct and that the party had no plans to alter its stance. "My job as shadow chancellor is to tell the British people the truth about the British economy," he said. "The truth is that it is the worst prepared economy in the world for recession.

times : ..."Alistair Darling, the Chancellor, also told Sky News: "All I would say is this, that a few weeks ago the Tories offered a bipartisan approach, now that has clearly gone to the wind."

Mr Osborne’s position is also considered to have been weakened by a lack of vocal support from David Cameron. The Shadow Chancellor was also forced to dismiss suggestions that his authority had been undermined because Mr Cameron had called in Oliver Letwin, his predecessor, to draw up potential government spending cuts.

Meanwhile, a significant party donor, the retail millionaire Lord Kalms, called for Mr Osborne to be replaced with a "heavyweight" figure.

But the Shadow Business Secretary, Alan Duncan, rallied around his frontbench colleague, saying he was "absolutely right" to raise the danger of a run on sterling. "I’d rather have George Osborne telling the truth than Gordon Brown charging around the world on a journey of deceit," he said.

torybulliestoo : VIDEO HERE

Sunday, 16 November 2008

...LET FIST AGIN

PALOOKAVILLE FINANCIAL stardate : capitulation day+58

...nobody lak a troof man...a bollox is busy agin...beatin up onna stiff wot tellin a troof...

...george osbourne...innit...tellin how a sterlin gon be mega red...an no f**ker wannit...

...alla cos a 'conomy screwed by economic policy o a unreconsructed labour...

...a bollox mus support Admiral Brown ta go rahn kikkin po likkle tory ass fo...

...tellin a truth...innit!

Friday, 14 November 2008

THE FUTURE IS NOT WHAT IT WAS

PALOOKAVILLE FINANCIAL stardate : capitulation day+56

...show me the way to go home...ahm tired an i wanna go ta bed...

...the story so far...

...a Christmas song is jangling inna background as George Baily careers across the slushy boulevard of Bedford Falls...

...he wishes he hadnay been born...

...harry Potter wants ta rename Bedford Falls...PALOOKAVILLE...

...Potter has magicked away the credit from the thrift that Baily runs...

...the stupid shmuck thought that ordinary people could profit from home ownership...

...wotta dunce!

...the wand was really the handle of the one armed bandit from the Vegas FED...

...Potter made it lever up the mortgage market...credit became the oil of the economic machine...

...then, at holiday time, while every one was out buyin stuff...

...potter waved the wand an the credit disappeared...

...puff went the smoke an mirrors...sh*t went the bloggers...jingle went the mail...

beulah : aye...we're aaalll...doooooommed......dooommed ah tell ee..

THE FUTURE THAT WAS

...people believed in the bubble an cashed in their paper gains on their homes as if they would keep on growing forever...

...Potter has now got them by the short an curlies an is lookin forward to explosive rental growth...

...he has been helped by the governments as they needed him to run this sh*t in order to maintain the illusion of prosperity upon which the voters smoked...

...now down has come cradle...baby an all...the keys is inna mail a jinglin an a janglin...

...an a further a property values fall...the further a debts rise...the bollox believe that things will bottom without the value of houses bottoming...

...well...good luck with that!...

peteyMacNeice : ..."the glass is fallin hour by hour, the glass will fall fo evva...

...but if you break the bloody glass...you'll no hold up the weather...

Thursday, 13 November 2008

THINGS AINT WHAT THEY USED TA BE

PALOOKAVILLE FINANCIAL stardate : capitulation day+55

...today on bloomberg...

Stocks in U.S. Slump on Economy; S&P 500 Falls to Lowest Level Since 2003

•U.S. Jobless Rolls Reach 25-Year High, Exports Drop as Growth Abroad Sinks

•GE Sticks With Dividend Policy as Shares Fall Below $15, Lowest Since 1996

•Goldman Sachs Employee Pay Will Be `Dramatically' Hit by Crisis, Palm Says

•Bulgari Abandons 2008 Earnings, Sales Forecasts on Slumping Jewelry Demand

vince : whahoppen muskie?

beulah : that freakin paulie wants lokkin up...bustin a banks an fixin a handout!...

laverne : does the bottom look big in this?

ambrose : .."The modern warning to us all is the "Lost Decade" in Japan, a loose term for the on-again, off-again slump that ultimately led to zero interest rates and – when that failed – to the printing of money. After 18 years, the Nikkei stock index is now trading at 8,700 – down from a peak of nearly 40,000. House prices have fallen by half. Yet after all the stimulus, the country is once again tipping back into deflation.

Governor King said Britain was likely to avoid this fate. "We've taken action much earlier than was the case in Japan," he said.

Not everybody agrees, even after the shock and awe cut of 1.5 percentage points by the MPC. Albert Edwards, global strategist at Société Générale, has long warned that central banks in the Anglo-Saxon countries have stored up trouble by stoking credit booms, and may find it harder than they think to engineer a soft-landing.

"This could easily go the way of Japan. It is true that Bank of England has moved faster, but Japan was a local bubble. This time it is the 'great unwind' on a global scale with leverage spaghetti everywhere," he said.

"The monetary authorities don't have foggiest idea themselves whether this is going to work. They're crossing their fingers and hoping," he said...."telegraph

petey : ahm feelin...in..sec..ure...ya mite not lurv me...any..more...

market ticker : ..."Without "silly credit", which cannot be restarted or maintained, we sell 11 million automobiles in the US a year, instead of 17.5 million. We sell one million fewer homes a year. Leisure travel dollars spent will fall by 20% and perhaps more. We sell a lot less "bling" of various sorts, whether it be $300 cell phones (the $50 one makes calls you know, and doesn't require a $100/month service plan either!), $5 lattes or $10 martinis. This is reality my friends, and there is no escaping it..."

Wednesday, 12 November 2008

DEFLATION

PALOOKAVILLE FINANCIAL stardate : capitulation day+54

...the story so far...

...some o a folks is sayin at 'flation gon be IN...an others is sayin it be gon be DE...

...here in PALOOKAVILLE we don know much abaht nuthin that caint be...

...whittled wiya knife...or cooked inna pot...

...so wot we duz is...sniff arahnd onna net an stuff n see wotta bloggas gotta say bout it...

...the regla bollox is sometimes useful too but usually abaht a month or two behind a best blogs...

THE GREAT DEBATE

'cat : yo...spider dude!...who is fairest of um all?

spider : don ast me man...ah jus guz an gets em fromma web innit?

opkin : seven freakin legs man!...wotta kinda spider is that?

beulah : yo shut yo gob ratfink...yo a rat anyhah...innit!

laverne : sure as sh*t iss a slump...

petey : ah thaank mish is a main man dudes!...an he say it gon be DEflation an then some...

zooneh : not fo nuthin is this painty dude our hero...

petey : i reads mish an ticker fo a hard stuff an barry an armageddon anna ninja too...

...fo a market take i laks ta read...slope an luna an ninja...

...fo a well researched economic hit i lak a news an econ...

...course i reads nouriel an john authers an AEP...an alla dudes inna side bar...

...ah guess ahm a miserable git an all...but a bearish case seems ta mek sense ta me...

...it aint ovva...fat lady still aint sang...ya nevva can tell but it look lak lower lows yet some...

...if they a rally ta christmas...then...include me aht...

Monday, 10 November 2008

TWO MINUTES SILENCE

PALOOKAVILLE FINANCIAL stardate : capitulation day+54

two minutes silence at 11 :00

spider :

opkin :

halfcat :

beulah :

laverne :

peteypaint :

STRANGE POST

PALOOKAVILLE : POINTS OF VIEW : stardate : capitulation day+53

spider : ...strange post man...

beulah : sucker lost it...

laverne : twat!

opkin : Dunce!!...

'cat : hooouuuwwwwwwwlllllllll...

machinepetey : ah allas lakked at story dudes...i seen it onna telly in blakanwite...

...wen ah wuz a kid...

...seems ta me lak it holda similarities ta a sh*t wot goin dahn...innit?...

...anyway ah posted it cos...ah jus wanted ta...love it or leave it sucker...

Sunday, 9 November 2008

THE MENDING APPARATUS

yo!...1909...innit!

PALOOKAVILLE FINANCIAL stardate : capitulation day+53

THE RED WEED

..." This was the Book of the Credit Machine...In it were instructions against every possible contingency...

...If she was hot or cold or dyspeptic or at a loss for a word, she went to the book...

...and it told her which button to press... ...The Central Committee published it...

...In accordance with a growing habit, it was richly bound...

ALL PRAISE THE MACHINE

..."The Machine," they exclaimed, "feeds us and clothes us and houses us...

...through it we speak to one another, through it we see one another, in it we have our being...

...The Machine is the friend of ideas and the enemy of superstition...

...the Machine is omnipotent, eternal; blessed is the Machine."

LATER...

..."The Machine stops."...

..."What do you say?"

"The Machine is stopping, I know it, I know the signs."

...She burst into a peal of laughter. He heard her and was angry, and they spoke no more...

"Can you imagine anything more absurd?" she cried to a friend...

..."A man who was my son believes that the Machine is stopping...It would be impious if it was not mad."

"The Machine is stopping?" her friend replied. "What does that mean? The phrase conveys nothing to me."

"Nor to me."

"He does not refer, I suppose, to the trouble there has been lately with the music?"

"Oh no, of course not. Let us talk about music."

VOTE...MACHINE..!

"The Machine," they exclaimed, "feeds us and clothes us and houses us; through it we speak to one another, through it we see one another, in it we have our being....

The Machine is the friend of ideas and the enemy of superstition...

...the Machine is omnipotent, eternal; blessed is the Machine."

THE CREDIT MACHINE STOPS

"Have you complained to the authorities?"

"Yes, and they say it wants mending, and referred me to the Committee of the Mending Apparatus...."...No one confessed the Machine was out of hand...

...Year by year it was served with increased efficiency and decreased intelligence...

...The better a man knew his own duties upon it, the less he understood the duties of his neighbour...

...and in all the world there was not one who understood the monster as a whole.

...Those master brains had perished...

...They had left full directions, it is true, and their successors had each of them mastered a portion of those directions.

But Humanity, in its desire for comfort, had over-reached itself...

...It had exploited the riches of nature too far...

...Quietly and complacently, it was sinking into decadence, and progress had come to mean...

...the progress of the Machine.

THE CENTRAL SCRUTINIZER

...To attribute these two great developments to the Central Committee, is to take a very narrow view of civilization.

The Central Committee announced the developments, it is true, but they were no more the cause of them than were the kings of the imperialistic period the cause of war.

Rather did they yield to some invincible pressure, which came no one knew whither, and which, when gratified, was succeeded by some new pressure equally invincible...

...To such a state of affairs it is convenient to give the name of progress.

petey : it were me wot messed abaht wiyit but...a story is from E M Forster

U.S. Weekly Leading Index Now at Six Decade Low

ZOMBIE ECONOMICS

PALOOKAVILLE FINANCIAL stardate : capitulation day+52

...all things must pass...even the car giants are mortal...the banks are mortal...

...in the long term...all are dead...

THE BUBBLE FLOATS BEFORE...THE SPECTRE STALKS BEHIND

...some time during eternity some guys show up...an one of them...

...who shows up real late...is a kind of economist...

...from some hick type place......like PALOOKAVILLE...

...who claims he is hep to what drives economies...

...and that the cat who really laid it on us is...keynes...

THEY BELIEVE

...they believe they can make water run up hill...that dying industries can be saved...

...that banks are too big to fail yet fail some...

...that votes can be bought with promises that will be forgotten...

...they believe that your savings are theirs to tax and theirs to raid...

...that your children can be left to pay the bill...

...that pork is meat and drink and the barrel is bottomless...

...they believe in dummies that they plan to educate down...

...and in outdated ideas from a distant past...

...they believe in nothing but themselves and their plans...

...the failing will be bailed out at the expense of the efficient...

...the future will be hostage to the past...

...the last shall be first and the first...last!

petey : read this

Friday, 7 November 2008

BUY ONE GET ONE FREE

PALOOKAVILLE FINANCIAL stardate : capitulation day+50

...the Emperor has been caught flashing he dick instead o wearin a latest fashions...

...some sucker took his finger outa damn an pointed at a Edude...an said...

... "is that a dick or wot"!

...almost immediately..they was a great intake o breath...an alla bubbles burst...

...dahn come baby..cradle an all...

...nah ya can git almost any thang yo wants...fo half price or less...

...an they still aint no takers...

...most o a financial bollox is sayin...itta buy signal...an before ya know it...

alla stocks be risin...anna sun shinin...anna normal service be resumed...

'cat : yo boss...is we is or is we aint buyers o stox man?

beulah : sucker aint gon bust ma pension on no shock an scares...

laverne : shudda nevah married at painty b*astard an all...

spider : seven f*ckin legs man...wot fo i got only seven...

opkin : nex f*cker calls me a rat...gon get his ass kicked...

bearpetey : ahm in cash mostly innit!...ahm lookin atta bollox an am...

...not convinced o a case fo investin any much cep onna nibbly type way...

zooneh : this chap seems ta have a take onnit...

Paul J Lamont : ..."As we stated last October (the month of the stock market’s peak); “the stock market is a sideshow, it can adjust to the economic reality very quickly as it did in 1929 (especially with credit losses already in place).”

Only misconceptions about the Great Depression cause a dismissal of the similarities. Commodities are correcting sharply as forecast. The U.S. Dollar has gained double-digits against other currencies while the Yen is “soaring to 13 year highs.”

The U.S. stock market (DJIA) has fallen below the ‘line in the sand’ described in March. And European countries are faring much worse as expected. Even our forecast for Mega Thrift is becoming more plausible.

How Low Can It Go?

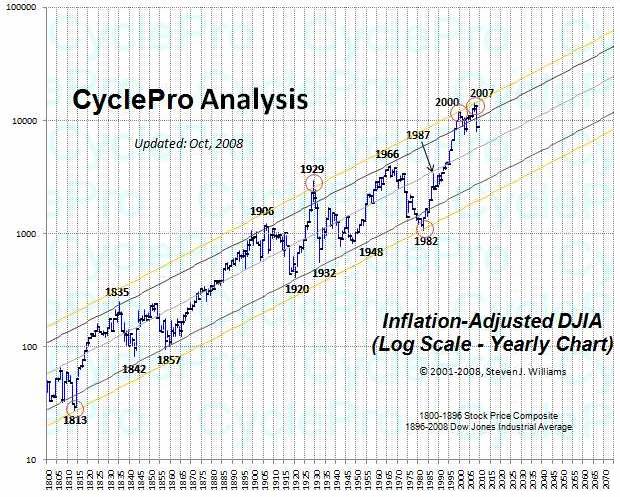

As mentioned in April of 2007, “When the effects of inflation have been extracted, the DJIA is much more cyclical than Wall Street promoters would care to admit.”

Steve Williams of Cycle Pro has updated his inflation-adjusted Dow Jones Industrial Average chart (below) which we previously cited. The recent sell off seems insignificant when viewed over the last 200 years. Our target is unchanged; we expect the market to swing to the lower end of the trend channel.

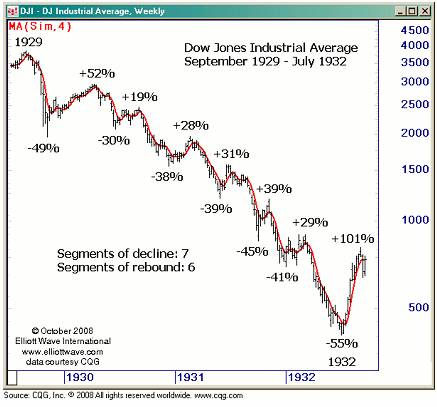

On the way to the bottom, the market must relieve bearish sentiment (make you forget your fear). It can only do this through sharp powerful rallies (where we all laugh for a day with CNBC on how close we came to the brink). We have described these as “rocket-launched (oh they’ve saved us) bear market rallies.” Investors who cheer these sharp up moves as a sign of the bottom should take note of the chart provided by Tom Denham from Elliotwave.com below.

Inflation - Negative Over the Next 5 Years

Because of high debt levels, we have continually warned of a deflationary collapse. Now according to Nouriel Roubini,

Finally, and more important, yields on Treasury Inflation-Protected Securities (TIPS) due in five years or less have now become higher than yields on conventional Treasuries of similar maturity. The difference between yields on five-year Treasuries and five-year TIPS, known as the break-even rate, fell to minus 0.43 percentage points. This is a record. Since the difference between the conventional Treasuries and TIPS is a proxy for expected inflation, the TIPS market is now signaling that investors expect inflation to be negative over the next five years, as a severe recession is ahead of us.

TIPS are signaling negative inflation for the next 5 years and inflation below 1% for the next 10 years! Therefore we would like to reiterate our call to investors to preserve their portfolios with U.S. Treasury Bills (interest bearing cash). Higher returns require more risk, which in our view will not be rewarded in this type of environment...." seeking alpha

bearpetey : thanx ta alla bloggers(specially em atta side bar) fo bein there in this sh*tty time an tellin alla suckers a troof an savin us all fromma msn bollox an...poverty...

Tuesday, 4 November 2008

WHAT'S YOURS IS THEIRS, WHAT'S THEIRS, THEIR OWN

PALOOKAVILLE FINANCIAL stardate capitulation day+48

...the very thing that... makes them rich... will...make you poooor!!!...

halfcat : yo boss...jus wot is it abaht all iss crisis sh*t that makes yo so uncool?

plastered : 'cat man...i jus don lak bullsh*t b*stards innit!...

...i wuz ovva at barry's an click a link ta bloomboig ta watch jimbo onna vid man...

...an he speak a lotta sense...not jus on investin but also nailed the people who are causin alla crap...

...seems lak mish an jimbo see the fed, an paulie, an alla wizards o oz as...

...the problem an not the solution...

...itta politix wot ruinin a future...proppin up a zombie banks an zombie companies...

...instead a lettin a good take ovva a assets o a bad...they bustin a public finances...

...ta protec they friends!

'cat : yo!...chill dude!..don go gettin poplexed...it all loada bollox anyhow innit?

peteypoplex : WTF man!..me pension goin dahn a pluggole innit!...

...me house value sinkin by a minute... freakin deflation nah...

follered by hyper-inflation whenna liquity jexions kick in...

...an alla time a politix gettin massive index linked pensions...

...fo f**kin up...

OH YEAH...

...an theys this..

bloomberg : ..."The U.K. spent its way into trouble. It can't spend its way out again. Taxes have risen too high, and debt has soared out of control. The nation needs to pay down its obligations and lessen its dependence on financial services. There is no reason it can't make that transition with hard work and some belt-tightening.

A final splurge of public spending will only postpone that adjustment and create a real risk of economic disaster."

(Matthew Lynn is a Bloomberg News columnist. The opinions expressed are his own.)

Sunday, 2 November 2008

LAND OF THE FALLING SUN

PALOOKAVILLE FINANCIAL stardate capitulation day+46

...the story so far...whilst innocently playing a game of pass the parcel...the world panicked as the music stopped an insde the parcel was anti-money...

...hisssss went the air from the credit bubble as the balloon went down...

...help cried the banks...

...save our suckers cried the politix...

peteysan : i been worryin abaht japan an stuff fo a while nah...innit?

zooneh : boss...yo shud see iss artikle fromma Sunday Times man!

stephen : ..."Almost 20 years ago Japan entered a protracted financial crisis, bear market and economic downturn. What lessons does that experience hold as the West struggles with a financial crisis?

The Japanese bubble peaked at the end of 1989 when the Nikkei Stock Average hit 38,915. Last Monday the index closed at 7,162, a fall of more than 80% over 19 years and the lowest close since October 1982.

At the peak of the boom in 1989, there were 19 big banks in Japan. By 2008, this had shrunk to eight. Of those only one still bears the name it did in 1989. The rest have failed, been swallowed up or nationalised...

.....The specifics of every banking crisis vary by country and by cycle, but the general forces are the same. When expanding gearing gives way to contracting debt, the stage is set for a liquidity crisis.

For Japan, this occurred in 1997-98. Two large brokers and one big money-centre bank failed, followed a few months later by the nationalisation of two long-term credit banks. A similar liquidity crisis has struck the West.

It is not obvious that the process in the US and the UK has been shorter. If you define the stock-market peak as 1999-2000 and the rally since early 2003 as no more than a relief rally (analogous to Japan’s recovery from 1992 to early 1996), then the timetable is actually similar.

A liquidity crisis has a sharp impact on lending to other parts of the economy. As a result, the economy slows and the debt built up by households and businesses becomes harder to support. This gives rise to the third and final phase: a solvency crisis. Japan’s big banks reached that point about five years after the liquidity crisis.

Three kinds of adjustment are needed before stability can return. First, asset values must discount the credit- constrained world. That is already happening with a vengeance, but take care not to assume too quickly that the process is complete.

A sucker rally (or three) should be expected, to make sure that hope is extinguished before share and house prices can return to any sustainable rising trend.

The Nikkei plunged about 40% in 1990-92, rallied by about one third, then traded between 15,000 and 20,000 from 1992 to early 2000. This range included three rallies of more than 30%....

...Third, the real economy must also adjust to the new credit constraints. In Japan’s case, car sales, land prices, bank lending and the household spending index have, like share prices, returned to the levels of the early 1980s.Corporate gearing ratios are at levels not seen for 40 years. Its economy has been through a wrenching adjustment over a long time.

Could it take this long in the West? Experience has taught that we should not rule out such a possibility. You could argue that the imbalances in the West are greater and have been allowed to build for longer than in Japan. It is that build-up of imbalances which will determine the scale and duration of this adjustment period rather than the actions of politicians and regulators (who have a tendency first to deny, then to fight the last battle rather than this one).

full article here

oh yeh..an it wuz me wot itallicked it cetra...